For Medical Billing and RCM companies, recovering patient balances is costly. It requires an investment in outbound and inbound patient communications and an orientation toward customer service. There are also high expenditures associated with data processing and sending paper statements. These expenses, combined with historically low collection rates, offer an insufficient return on investment compared to managing other aspects of the revenue cycle.

To better understand how medical billers can effectively recover patient AR and provide a positive patient experience, we break down two of the five major cost centers associated with patient AR and how to manage these activities successfully:

- Manual data processing

- Managing payment plans

Manual Data Processing

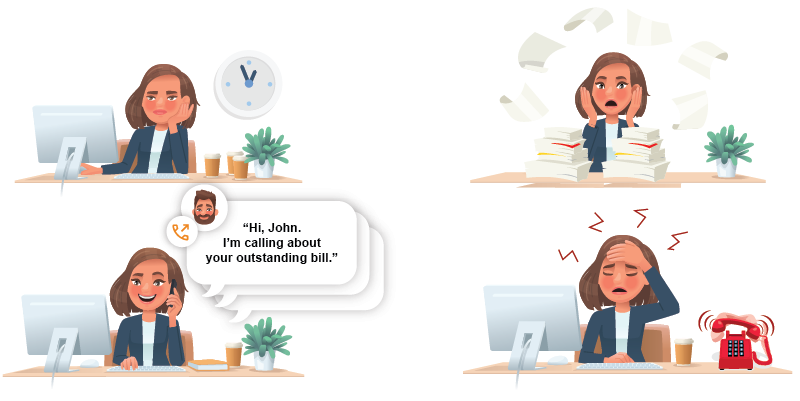

Data processing is a huge cost driver in recovering patient balances. Managing patient AR requires teams of people to process information manually, update patient records, verify contact information, and process and post payments. In addition, most medical billing and RCM companies work in disparate billing, EHR, or PM systems, adding to the complexity and overhead of manually processing patient AR data.

For example, We analyzed the amount of effort it took one mid-size RCM company to organize data between a dozen EHRs for 30,000 patients with a balance. The analysis showed that their team averaged 700,000 mouse clicks per week to manage patient AR, diverting their effort from more business-critical work.

With robotic process automation and AI advancements, tasks that require manual data processing can be automated between various systems to reduce effort, improve efficiency, and decrease human error. Billing team members can then focus on higher ROI work.

Managing Payment Plans

Consumer prices are rising fast, and healthcare expenses are increasing faster than overall inflation. According to McKinsey, increased healthcare costs could result in reduced benefits and higher consumer out-of-pocket costs. In addition, current economic circumstances put significant financial pressure on US consumers who already have difficulty affording healthcare.

Higher out-of-pocket costs and people’s inability to afford healthcare create challenges for companies managing patient AR and their provider clients. However, as patients continue to account for more revenue, supporting and managing payment plans that help people handle their healthcare costs will be necessary to recover patient balances.

For medical billing and RCM companies to support payment plans at scale, they must have a digital self-service facility for patients to set up payment plans independently. Managing payment plans, establishing terms, processing routine payments, and handling patient communications are far too costly. The key to a successful automated payment plan system is to allow patients to set terms that work with their budget, automate all communications about the payment plan, and have a credit card or bank account on file to cover the recurring charges.

Our next blog post will explore ways to better manage customer service, patient outreach, and how to decrease material costs associated with recovering patient balances.